YOU CAN'T AFFORD TO RELY ON JUST YOUR BOOKKEEPER AND ACCOUNTANT

We Train You To Be The CFO Of Your Business

Over 225 Companies Served Across 40+ Industries

YOU CAN'T AFFORD TO RELY ON JUST YOUR BOOKKEEPER AND ACCOUNTANT

We Train You To Be The CFO Of Your Business

Over 225 Companies Served Across 40+ Industries

Does This Sound Like You?

- Your business is growing fast and expenses are getting out of control

- You're wanting to hire but are worried it will cut into your profits or force you to reduce your take home pay

- You've had an influx of revenue and don't know how to allocate the money

- Your poor (pun intended) past with money is creeping back in and feel like you might self-sabotage the business

- You thought hiring an Accountant and Bookkeeper would solve all of your money problems

Watch this video to see why you need a Financial Coach

Why Would You Hire A Financial Coach If You Already Have A Bookkeeper & Accountant?

Robert Heath, Sr., CEO at The Legacy Leadership Consulting Group Explains Why He Chose To Work With Us Even While Having a Dedicated Bookkeeper and Accountant

Whether You Want To Be Trained How To Manage Your Company's Business Finances Or You Want Us To Do It For You, We've Got You Covered

The Academy - Owner Training

We have multiple versions of our 1:1 financial coaching program, "The Academy", but all include:

Done For You Bookkeeping Review

Weekly 45 Minute Meetings with Your Dedicated Profit Coach

Fractional CFO Services

We become your financial partner to help you scale profitably (for companies doing $3M+ in revenue)

12 Month Rolling Cashflow Projections & Budget Overviews

2x Monthly CFO Meetings with Your Fractional CFO

What Our Clients Are Saying About Working With Us

What Our Clients Are Saying About Working With Us

Jason Lundy

Lodestar Construction

CEO Finance Academy Review

Simona Rozhko

Evna Media

CEO Finance Academy Review

Jason Lundy

Lodestar Construction

CEO Finance Academy Review

Simona Rozhko

Evna Media

CEO Finance Academy Review

Why Would You Hire A Financial Coach If You Already Have A Bookkeeper & Accountant?

Robert Heath, Sr., CEO at The Legacy Leadership Consulting Group Explains Why He Chose To Work With Us Even While Having a Dedicated Bookkeeper and Accountant

Whether You Want To Be Trained How To Manage Your Company's Business Finances Or You Want Us To Do It For You, We've Got You Covered

The Academy - Owner Training

We have multiple versions of our 1:1 financial coaching program, "The Academy", but all include:

Done For You Bookkeeping Review

Weekly 45 Minute Meetings with Your Dedicated Profit Coach

Fractional CFO Services

We become your financial partner to help you scale profitably (for companies doing $3M+ in revenue)

Done For You Bookkeeping Review & Ongoing Process Training

12 Month Rolling Cashflow Projections & Budget Overviews

What Our Clients Are Saying About Working With Us

Jason Lundy

Lodestar Construction

CEO Finance Academy Review

Simona Rozhko

Evna Media

CEO Finance Academy Review

Brands We Have Had That Pleasure Of Serving

Why We're On A Mission To Change How Business Owners Manage Their Finances

Plus 180 More and Counting

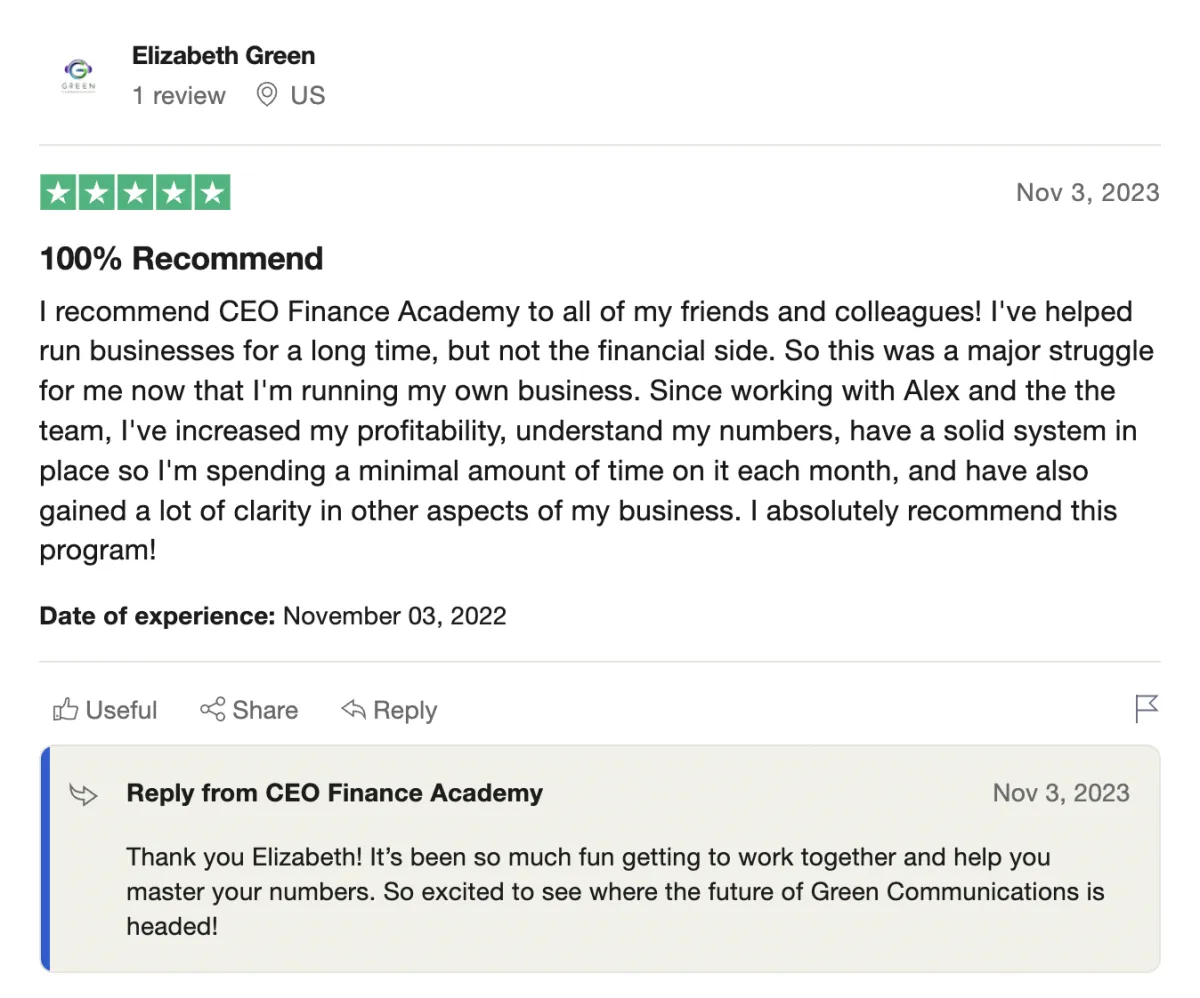

TESTIMONIALS

What Our Clients Say

Melissa Buffer

Brick and Mortar Owner

Josh Payne

Online Business Coach

Raj Padalia

Investing Consultant

Betty Delass

Healthcare Practice Owner

Duane Scotti

Online Fitness Coach

“You have helped me SO MUCH with this. I finally feel confident and secure in my abilities to do this business thing without a job as a safety net. Forever grateful.”

Brooke Czarnecki

Dietician Private Practice Owner

"It's been phenomenal working with Alex & Will with my business finances. Before them, I didn't have a systematic way of handling it or even truly understand what impact it was having on my personal life. If you are looking to scale your business, have more peace of mind, and find more profit in your business don't wait."

Joey Allbritton

Marketing Agency Owner

CEO Finance Academy

Healthy Funnel, LLC

DBA: CEO Finance Academy

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Instagram

LinkedIn

Youtube